Software supply chain attacks continue to challenge financial institutions. Many teams now operate large application stacks built with open-source libraries, vendor software and internal code. Without clarity on these components, it becomes difficult to manage exposure effectively.

Regulators such as RBI, SEBI and CERT-In now require organisations to maintain clear, accurate SBOMs in recognised SBOM formats. These documents improve visibility, strengthen audits and support rapid response during vulnerability events. This guide explains the required SBOM formats and the mandatory fields defined by each regulator.

Why SBOM compliance matters

Supply chain threats have risen sharply. Reports show:

- A 580 percent increase since 2021, driven by flaws in third-party components and compromised vendor software.

- Modern applications rely heavily on external libraries. Estimates place this between 70 and 80 percent of the overall codebase.

This shift makes SBOMs a useful tool for managing risk. When maintained in the right SBOM formats, they help teams:

- Spot known vulnerabilities early

- Validate licence obligations

- Respond faster to zero-day alerts

- Improve supplier transparency

- Present detailed evidence during audits

Regulatory lens: RBI, SEBI, and CERT-In

Financial regulators in India now treat SBOMs as part of essential oversight. Each regulator focuses on slightly different aspects of software transparency.

1. RBI: follow CERT-In’s SBOM guidelines

RBI’s CSITE Advisory No. 11/2024 instructs all Regulated Entities (REs) to adopt CERT-In’s SBOM technical guidelines and obtain SBOMs from internal and third-party developers.

“REs shall obtain assurances regarding the accuracy, completeness, and timeliness of SBOM.”

What RBI expects:

- SBOMs for critical applications.

- SBOMs from all vendors & third-party suppliers.

- Conformance with CERT-In’s 21 SBOM fields.

For RBI-supervised organisations, CERT-In’s fields are the baseline.

Find more about what RBI instructs for stronger software supply chain security in our blog How to meet RBI SBOM Compliance.

2. SEBI: minimum SBOM fields under CSCRF

SEBI’s CSCRF requires SBOM inventories for all core, critical and business applications. SBOM is explicitly mentioned as part of the cybersecurity requirements.

SEBI prescribes 9 SBOM fields, focusing heavily on governance and integrity:

- Licensing and supplier information.

- Dependency mapping.

- Encryption used.

- Integrity (hashes).

- Update frequency.

- Known-unknown declarations.

- Access control.

- Error-handling processes.

3. CERT-In: detailed 21-field SBOM baseline

CERT-In’s SBOM Guidelines (referenced by RBI) provide the most comprehensive list of compliance fields, covering metadata, integrity, vulnerabilities, and lifecycle data.

CERT-In also connects:

- SBOM with CBOM (Cryptographic BOM).

- SBOM with PQC (Post-Quantum Cryptography) readiness.

- SBOM integration with SDLC.

SBOM fields under CERT-In and SEBI

Understanding the SBOM fields mandated by SEBI and CERT-In is no longer optional. Rather, it’s a core compliance and governance requirement. These fields give organisations complete visibility into the components that make up their software, whether built internally or sourced from third-party vendors.

1. CERT-In SBOM field mapping (21-field baseline)

Teams working under RBI must meet each CERT-In field. All fields remain unchanged and appear below as required.

CERT-In 21 SBOM Fields

| SR | FIELD | DESCRIPTION | GENERATION METHODS |

| 1 | Component Name | Software component name | Automated |

| 2 | Component Version | Build/version identifier | Automated |

| 3 | Component Description | Component purpose/function | Automated |

| 4 | Component Supplier | Vendor or OSS provider | Automated |

| 5 | Component License | MIT, GPL, Apache etc. | Automated |

| 6 | Component Origin | OSS/proprietary/internal | Semi-Auto |

| 7 | Component Dependencies | Transitive + direct deps | Automated |

| 8 | Vulnerabilities | Known CVEs | Automated |

| 9 | Patch Status | Patch availability | Automated |

| 10 | Release Date | Release date | Automated |

| 11 | End-of-Life Date | Vendor-announced EOL | Automated |

| 12 | Criticality | Business/tech criticality | Manual |

| 13 | Usage Restrictions | Licence/internal restrictions | Manual |

| 14 | Checksums/Hashes | SHA-256/512 | Automated |

| 15 | Comments/Notes | Free-text notes | Manual |

| 16 | Author of SBOM Data | System/user generating SBOM | Automated |

| 17 | Timestamp | SBOM captured time | Automated |

| 18 | Executable Property | Binary/executable flag | Automated |

| 19 | Archive Property | Zip/tar/etc packaging flag | Automated |

| 20 | Structured Property | Extended metadata | Automated |

| 21 | Unique Identifier | UUID, pURL, CPE | Automated |

2. SEBI SBOM field mapping (9 fields)

SEBI’s focus is on the management of the SBOM and its data. These fields ensure the SBOM is trustworthy and governed correctly.

| SEBI FIELD FOCUS | DESCRIPTION | GENERATION METHODS |

| Licence Information | Detailed licence metadata | Automated |

| Encryption Used | Algorithm, protocol, key length | Automated |

| Component Hash | SHA-256/512 for integrity | Automated |

| Frequency of Updates | Org-defined update cadence | Manual |

| Access Control | RBAC for SBOM artefacts | Automated |

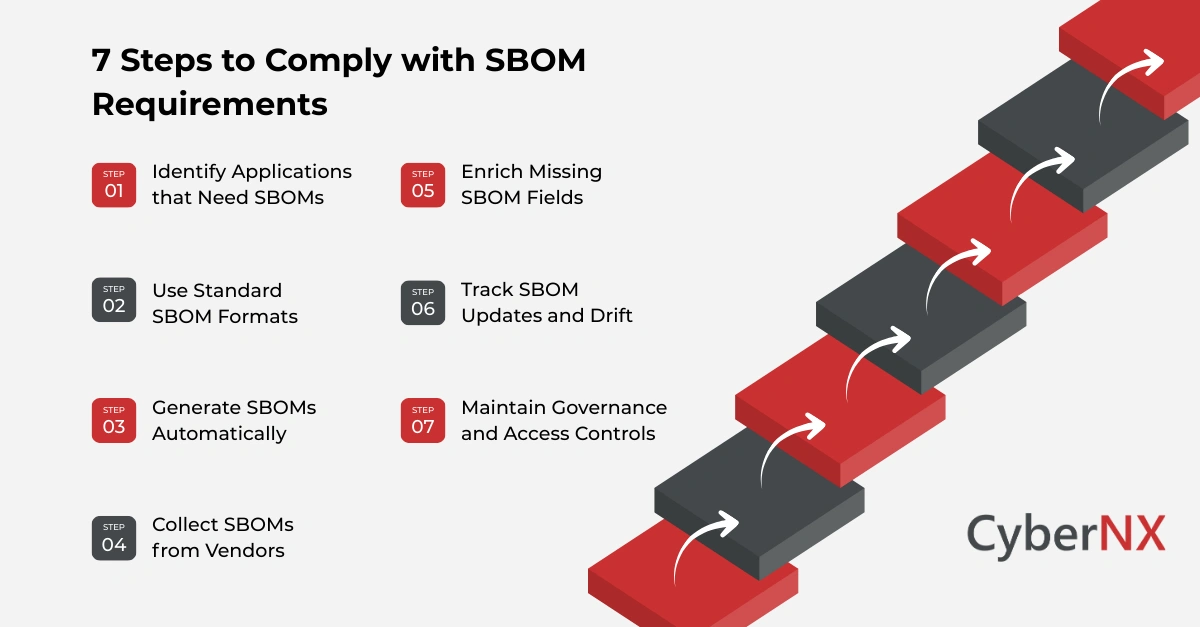

How to operationally comply with SBOM Requirements (7-step path)

Compliance requires a robust, repeatable process, not a one-time scan. This 7-step path, achievable through SBOM lifecycle management platforms, which operationalises the regulatory demands.

Step 1 – Identify Applications That Need SBOMs

Regulators require SBOMs for critical systems, customer-facing applications, systems processing payments or sensitive data, and vendor-supplied critical software. Start small but start with the most critical.

Step 2 – Use Standard SBOM Formats

Regulator-aligned SBOM Formats: CycloneDX (recommended) and SPDX (ISO-approved). Using standardised formats ensures data can be exchanged reliably with regulators and vendors.

Step 3 – Generate SBOMs Automatically

Integrate SBOM generation into your development workflow. The best way is to generate SBOMs via CI/CD pipelines or by scanning binaries and images. This ensures the SBOM is a real-time artefact.

Step 4 – Collect SBOMs from Vendors

RBI’s advisory is explicit: vendors must provide SBOMs. Use a secure method, like a dedicated vendor portal, to collect, validate, and store third-party SBOMs.

Step 5 – Enrich Missing SBOM Fields

Most raw SBOMs are incomplete. Use manual enrichment or AI-based enrichment to ensure full coverage of the 21 CERT-In and 9 SEBI fields.

Step 6 – Track SBOM Updates and Drift

A stale SBOM is a compliance risk. You must track updates, maintain version history, and use drift detection to identify changes between the build and deployment environments.

Step 7 – Maintain Governance and Access Controls

Implement RBAC, detailed audit logs, and defined error-handling processes to satisfy SEBI’s strong governance requirements.

Why NXRadar is the easiest way to achieve SBOM compliance

NXRadar is purpose-built for the unique regulatory landscape of India, providing a single platform to manage the complex, cross-cutting requirements of RBI, SEBI, and CERT-In.

| FEATURE | COMPLIANCE BENEFIT |

| Full Field Support | 21/21 CERT-In and 9/9 SEBI SBOM Fields are natively supported. |

| Automation + AI | Automated generation and AI enrichment ensure compliance with all mandated fields, reducing manual effort. |

| Third-Party Collection | Securely collect and validate vendor SBOMs as required by RBI. |

| Integrated CBOM | Support for CBOM (Cryptographic BOM) helps satisfy CERT-In’s extended security requirements. |

| Audit-Ready Reports | Provides real-time, audit-ready reports tailored for specific RBI/SEBI/CERT-In reviews. |

Conclusion

SBOM compliance is now mandatory across India’s financial ecosystem. RBI expects adherence to CERT-In’s detailed technical guidelines, while SEBI adds crucial governance and integrity controls. This makes SBOM not just a technical artefact, but a continuous compliance requirement.

By adopting a structured, automated SBOM process and leveraging a specialised platform like NXRadar, organisations can satisfy all regulatory requirements, strengthen software-supply-chain security, and be fully audit-ready across all regulators. Our team at CyberNX helps financial institutions put these practices in place with ease. Connect with us to know more about in-house SBOM management tool and how it can help you meet RBI, SEBI and CERT-In compliance requirements.

SBOM formats FAQs

Which SBOM formats do regulators accept?

Regulators recognise CycloneDX and SPDX because both provide structured, audit-friendly metadata. CycloneDX suits security and vulnerability workflows, while SPDX supports strong licence governance. CERT-In allows both, but expects complete and consistent fields regardless of format.

Do vendors need to share SBOMs regularly?

Yes. RBI expects vendors to provide updated SBOMs whenever they release critical patches, security fixes or major version changes. This ensures regulated entities can track drift, validate integrity and respond quickly if a dependency becomes weak or compromised.

Does an SBOM detect unknown vulnerabilities?

Not directly. An SBOM lists components and versions, which helps teams act fast when a new zero-day is announced. It reduces investigation time, because teams already know exactly where the affected dependency sits inside the environment.

How often should teams refresh SBOMs?

Teams should regenerate SBOMs at every key build, release or vendor update. Regular refreshes keep metadata accurate, reduce audit friction and prevent outdated component lists from weakening compliance readiness.