At 9:30 a.m. on a trading day, a vulnerability alert lands in the inbox of a CISO at a large brokerage firm. The CVE flags a widely used open-source library buried deep inside a trading platform. That platform itself is built from hundreds of vendor-supplied components.

One question surface immediately, with no room for delay. Are we exposed?

Without an SBOM, the answer takes days. Teams scramble, emails fly, vendors respond slowly, and confidence erodes by the hour. With an SBOM, the answer takes minutes. That difference now defines operational resilience for Indian businesses.

The Software Bill of Materials, or SBOM, has moved well beyond engineering hygiene. It is now a matter of executive accountability. For banks, insurers, brokerage firms, fintechs, and any organisation that builds or runs software, SBOMs sit firmly at the intersection of security, compliance, and trust.

What is an SBOM, in simple terms?

Let’s understand SBOM in a software cycle.

Step 1: Coding

Every application starts as code written by developers. This code may use different technologies like JavaScript, Python, or Go. But here is the key part. Most of this code is not written from scratch.

Developers reuse existing building blocks. These include open-source libraries and modules created by others. They save time, but they also bring hidden risk. Then, the code gets packaged.

Step 2: CI/CD Pipeline and Artifact

Once developers finish their work, the code moves through an automated factory line called a CI/CD pipeline. If everything works, the pipeline produces a final output. This output is called an artifact.

An artifact is simply the finished software in a usable form.

It could be:

- A container image

- A software package

- A compressed file

This is what gets deployed, shared with customers, or installed on servers.

Step 3: Now comes the SBOM

At this stage, we know everything that went into the software.

Using that information, an SBOM is created and linked to the artifact.

The SBOM lists:

- Every library used

- Every dependency pulled in indirectly

- The versions of each component

For Indian organisations, SBOMs are no longer informal artefacts. They are shaped by clear regulatory expectations.

Why are SBOMs important for Indian businesses?

The primary driver is the rapid escalation of software supply chain attacks. Since 2021, these attacks have increased by over 580 percent, and India’s regulated sectors remain attractive targets.

Modern applications now depend heavily on external code. In many enterprises, 70 to 80 percent of the codebase comes from third-party libraries. That reality creates several risks that SBOMs are uniquely positioned to address.

1. Managing hidden risks

Most serious vulnerabilities do not live in first-party code. They hide in transitive dependencies, several layers deep. Incidents like Log4j exposed how blind organisations can be without clear dependency visibility. SBOMs shine a light into these blind spots.

2. Accelerated incident response

When a new CVE is announced, speed matters. An SBOM allows security teams to instantly identify affected systems, versions, and vendors. This replaces weeks of manual code reviews with targeted, confident action.

3. Regulatory compliance

Indian regulators increasingly treat SBOMs as standard audit artefacts. For RBI and SEBI regulated entities, non-compliance can trigger penalties of up to ₹1 crore, along with business restrictions and supervisory scrutiny. SBOMs help shift conversations from justification to assurance.

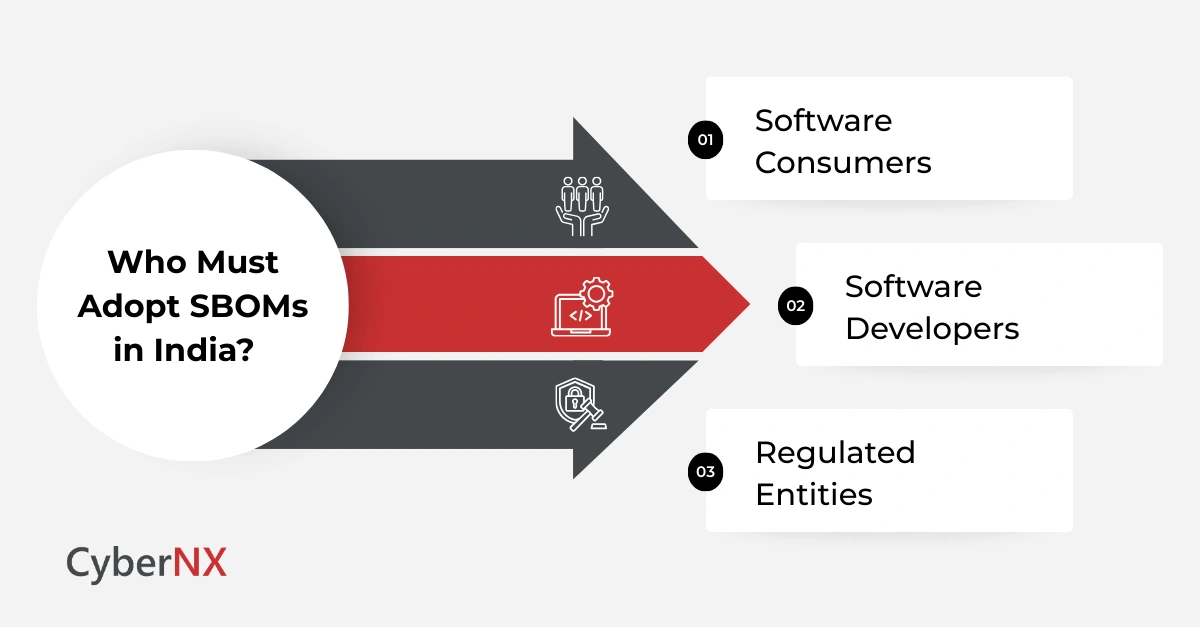

Who must adopt SBOMs?

Guidelines issued by CERT-In and financial regulators clearly identify three groups that must take ownership of SBOM adoption.

1. Software consumers

Government departments and essential service providers, including banks and power sector organisations, must demand SBOMs as part of procurement. Trust can no longer be implicit. It must be documented.

2. Software developers

Organisations building custom or commercial software must generate and deliver accurate SBOMs alongside their products. This is becoming a basic expectation, not a premium feature.

3. Regulated entities

Banks, NBFCs, and SEBI registered intermediaries remain accountable for the security of their entire supply chain. That responsibility extends beyond internal code to every external dependency they rely on.

Want to explore SBOMs in greater depth? Download our detailed SBOM whitepaper here:

Where are SBOMs implemented?

SBOM management spans the entire Software Development Lifecycle and the wider business ecosystem. It is not confined to a single team or phase.

- In development: SBOM generation is automated within CI and CD pipelines. Each build, release, or patch updates the SBOM, ensuring it remains a living artefact rather than a static document.

- In procurement: SBOM requirements are increasingly written into vendor contracts. They are treated as non-negotiable deliverables, just like SLAs and security clauses.

- In operations: Security teams integrate SBOM inventories into vulnerability management platforms and SOC workflows. This allows faster triage, prioritisation, and remediation when new threats emerge.

When should SBOMs be implemented?

For Indian businesses, the timing is now.

RBI regulated entities are already expected to maintain SBOMs for critical applications and enforce SBOM obligations in all new vendor contracts. SEBI regulated entities moved into full compliance after the August 2025 CSCRF deadline, making SBOMs an established audit expectation rather than a future requirement.

Beyond regulatory timelines, SBOMs must operate continuously. They should be embedded from design and development, demanded during procurement, regenerated with every build or patch, and monitored at runtime. This continuous approach helps detect drift, emerging vulnerabilities, and new supply chain exposures in near real time.

How do businesses comply and implement SBOMs?

CERT-In and industry experts recommend a phased maturity model supported by automation and tooling.

1. Start phase

Identify critical assets such as payment gateways and trading platforms. Decide on standard formats like SPDX or CycloneDX. Begin acquiring SBOMs from all strategic vendors.

2. Progress phase

Assign unique identifiers such as Package URLs to components. Resolve version ambiguity. Integrate SBOM generation and validation into the secure SDLC.

3. Advance phase

Enable runtime monitoring to detect drift between build and deployment. Automate ingestion of vulnerability feeds and security advisories.

4. Risk mitigation

Use VEX and CSAF documents to distinguish exploitable vulnerabilities from non-issues. This allows teams to focus remediation efforts where they truly matter, instead of chasing noise.

Conclusion

SBOMs change how organisations trust software. They replace assumptions with evidence. For Indian banks, insurers, brokers, and software firms, SBOMs now define readiness, resilience, and regulatory standing.

The invisible list now decides visible outcomes.

Are you ready to strengthen your SBOM strategy? We work alongside your teams to design, implement, and operationalise SBOM programmes that meet regulatory expectations and reduce real-world risk.

NXRadar is our AI-enabled SBOM management tool built to help regulated organisations generate, validate, enrich and govern SBOMs at scale. Speak with our experts to understand where you stand and how quickly you can mature.

A Quick Guide to SBOM FAQs

How do SBOMs differ from traditional asset inventories?

Traditional inventories track applications and systems. SBOMs go deeper by mapping every software component and dependency within those applications.

Are SBOMs required for legacy applications?

Regulators expect coverage for critical applications, including legacy systems, especially where third-party components are involved.

Can SBOMs be shared securely with regulators and partners?

Yes. Machine-readable formats support controlled sharing while protecting sensitive intellectual property.

Do SBOMs replace vulnerability scanning tools?

No. SBOMs complement scanning tools by providing context, accuracy, and faster correlation during incidents.