The DPDP Act introduces robust obligations for organisations processing digital personal data in India. Equally important are the penalties under the DPDP Act, which decision-makers must treat as a key risk lever. For cybersecurity leaders, understanding the penalty landscape helps prioritise remediation, allocate budget and shape governance. In this blog, we explain and simplify penalties under DPDPA.

Why the penalty framework matters

Penalties under the DPDP Act are more than fines. They serve as an enforcement signal and affect business risk, vendor relationships and reputational standing. Major consequences include:

- Financial risk: Significant fines per violation elevate the cost of non-compliance.

- Operational risk: Enforcement may trigger audits, investigations and disruption of business processes.

- Reputational risk: Public penalties can erode trust among customers, partners and regulators.

- Legal Consequences: Potential criminal liability for certain violations could mean sleepless nights for boards and C-suite executives.

Key penalty tiers and triggers

The Act outlines several tiers of penalties; each tied to specific obligations. Below is a concise table summarising main categories:

| VIOLATION CATEGORY | MAXIMUM PENALTY | TRIGGER / EXPLANATION |

| Failure to implement “reasonable security safeguards” (Section 8(5)) | Up to ₹ 250 crore. | Applies when data fiduciary fails basic technical/organisational controls and results in a breach or risk. |

| Failure to notify the Board or affected data principals of a personal-data breach (Section 8(6)) | Up to ₹ 200 crore. | Triggered by late/delayed/missing breach-notification. |

| Breach of obligations relating to children’s data (Section 9) | Up to ₹ 200 crore. | Applies when processing children’s digital personal data without required safeguards. |

| Breach of obligations by a “Significant Data Fiduciary” (Section 10) | Up to ₹ 150 crore. | Applies to entities designated significant with higher duties (audits, DPIAs, etc.). |

| Any other violation (catch-all category) | Up to ₹ 50 crore. | Covers miscellaneous obligations not individually tiered. |

| Duties of data principals (individuals) | Up to ₹ 10,000. | Applies when an individual misuses their data-rights or provides false information. |

How penalties are calculated

When the Data Protection Board of India assesses a penalty under the DPDP Act, they consider multiple factors:

- Nature of the contravention (how serious the breach or omission was).

- Duration and recurrence of the violation (single vs repeated).

- The harm (or risk of harm) to data principals.

- The size and turnover of the data fiduciary (though Act uses flat ceilings).

- Steps taken by the fiduciary to remediate and cooperate.

The Act also allows penalties per instance of violation – meaning multiple breaches can stack, increasing overall exposure.

Comparison with global privacy fines

While the GDPR bases fines on turnover, the DPDP Act uses flat ceilings. However, the relative impact on Indian entities – especially SMEs and start-ups – can be equally severe.

| REGULATION | TOP FINE CEILING | APPLICABILITY |

| EU GDPR | Up to € 20 million or 4 % of global turnover (whichever is higher) | All personal-data processing across the EU. |

| DPDP Act (India) | Up to ₹ 250 crore (~€ 27 million) per incident | Digital personal-data processing in or relating to India. |

Practical implications for enterprises

Keeping the penalties in mind, these are some steps public and private organisations should take:

- Vendor & third-party risk: As a data fiduciary remains fully accountable even if a vendor mis-processes data. Non-compliance via a third party can trigger high penalties.

- Security investment priority: With the top tier (₹ 250 crore) tied to security safeguards, organisations must invest proactively in technical controls, monitoring and incident readiness.

- Governance and audit readiness: Significant Data Fiduciaries must ensure audit trails, DPIAs, controls maps and escalation processes to reduce risk of the ₹ 150 crore tier.

- Board & executive visibility: Penalty ceilings provide tangible metrics for board-briefing, risk registers and compliance dashboards.

- Insurance considerations: Insurers are increasingly reviewing whether DPDP fines are insurable in cyber-risk policies; however, subjectivity of “reasonable measures” remains a challenge.

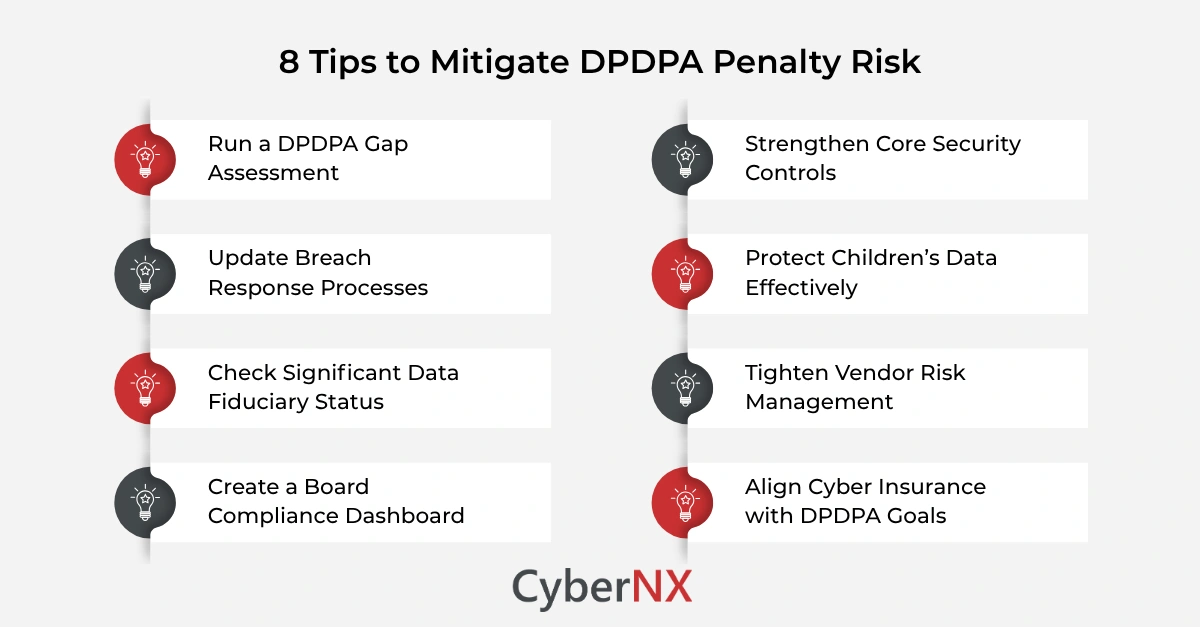

Tips to mitigate penalty risk

Organisations can significantly reduce exposure through structured action.

- Conduct a gap assessment against DPDP obligations and map where your highest exposure ceilings exist.

- Prioritise security controls aligned to best practices (e.g., encryption, access controls, monitoring, incident-response) to reduce the risk of the highest penalty tier.

- Update breach-notification processes so you meet timelines and document all decisions to avoid the second-tier exposure.

- For children’s data, ensure enhanced consent, age-verification and special handling workflows.

- Identify whether you are designated a “Significant Data Fiduciary” and implement additional governance (e.g., internal audits, external assurance).

- Maintain strong vendor management. Conduct due diligence, contractually flow down obligations, monitor vendor compliance.

- Develop a board-level dashboard capturing active investigations, compliance gaps, vendor risk and upcoming deadlines.

- Consider cyber insurance alignment. Engage insurers early, share your DPDP compliance roadmap and negotiate coverage for civil fines.

Conclusion

Penalties under the DPDP Act are designed to drive accountability, not simply deter non-compliance. For businesses processing digital personal data in India, the ceilings – up to ₹ 250 crore – cannot be ignored. It is important to translate these regulatory exposures into action: reviewing your controls, setting remediation plans, aligning governance and monitoring vendor risk.

Ready to assess your penalty risk under the DPDP Act? Contact us for a DPDP Act Consultation where our experts will help you with a risk-focussed compliance roadmap. We develop tailored compliance strategies for different sectors like BFSI, healthcare, e-commerce, addressing unique data processing challenges.

Penalties under the DPDP Act FAQs

Are imprisonment penalties included under the DPDP Act?

No. The DPDP Act does not provide for imprisonment for data fiduciary breaches; enforcement is via civil monetary penalties.

Can penalties be imposed more than once for the same incident?

Yes. The Act allows penalties per instance of contravention, and multiple breaches or repeated failures can result in cumulative penalty exposure.

Does paying a penalty prevent further action?

No. Payment of a penalty does not absolve the data fiduciary from rectifying the breach or following directions from the Board. Continued non-compliance may lead to further action or blocking of services.

Can individuals (data principals) claim compensation via the Board?

The Act creates enforcement by the Board and penalty collection goes to the Consolidated Fund of India, but individual compensation claims may need separate civil action.