The financial services industry is built on data. Banks, insurers, fintechs in the Digital Personal Data Protection Act, 2023 (DPDP Act) era must rethink how they collect, process and protect personal data.

The importance of the DPDP Act for the BFSI sector cannot be overstated. Firms now face stricter consent rules, higher expectations of security and significant regulatory overlap.

In the last few years, we’ve seen many organisations in India struggle with legacy systems and fragmented data practices. However, on the other side of spectrum, many organisations have successfully prepared themselves to brace the DPDP Act impact. This blog unravels how you can confidently ace the compliance challenge and more.

What the DPDP Act brings to the table

What has changed since DPDA Act, 2023? Why they matter for the BFSI sector? Every leader in the financial sector needs to know the answers to these questions to make their respective organisations future ready.

1. Scope and significance

The Act applies to digital personal data processed within India and also to data processed outside India if it relates to Indian individuals or services. It defines roles such as Data Principals (individuals), Data Fiduciaries (organisations processing data) and Significant Data Fiduciaries (SDFs) – entities with higher obligations based on the volume/sensitivity of data.

Because BFSI sector handles identity, transaction, credit-history and behavioural data, most large institutions are likely to fall into the SDF bucket.

2. Elevated rights for individuals

Under the Act individuals (Data Principals) receive enhanced rights: to access their data, correct it, erase it (subject to some exceptions), and withdraw consent. For BFSI organisations this means revisiting onboarding, KYC-flows, consent notices and data-retention logic.

3. Stricter obligations on processing

The Act mandates clear, informed, affirmative consent for data collection and processing – particularly important in financial services where data is used for underwriting, analytics, cross-sell etc.

It emphasises purpose limitation and data minimisation: only collect what you need, for defined reason, and delete once purpose is completed (unless legal/regulatory retention requires otherwise).

Also, there are robust security obligations – encryption, audit, vendor oversight, breach notification, etc.

4. Alignment and overlap with BFSI-specific regulation

The BFSI sector is already regulated by Reserve Bank of India (RBI), Insurance Regulatory and Development Authority of India (IRDAI), Securities and Exchange Board of India (SEBI) etc who impose rules on data retention, KYC, cybersecurity and outsourcing. The DPDP Act adds a parallel layer.

For example: KYC records retention (RBI requirement) may conflict with erasure rights under the DPDP Act. Organisations will need to harmonise and not treat DPDP as a stand-alone checklist.

Major challenges the BFSI sector faces

We know the BFSI sector has unique challenges when it comes to data. Here are a few that the DPDP Act directly touches.

1. Data volume & sensitivity

Banks and insurers hold large volumes of personal data, including sensitive financial data, credit history and transaction behaviour. This elevates risk from both a compliance and reputational view.

2. Legacy systems & third-party dependencies

Many BFSI entities operate with legacy IT systems, outsourcing functions, complex vendor relationships and multiple digital touch-points (fintech partners, aggregator platforms). Ensuring compliance across the chain is harder.

3. Trust and customer expectations

In a digital-first world, customers expect transparency around how their data is used. A data breach or poor data governance can severely damage trust – something the DPDP Act seeks to address.

4. Regulatory complexity

As noted, BFSI firms face overlapping regulations. The DPDP Act adds another dimension. Without proper alignment, firms risk inconsistent policies, gaps in compliance or even conflicting obligations.

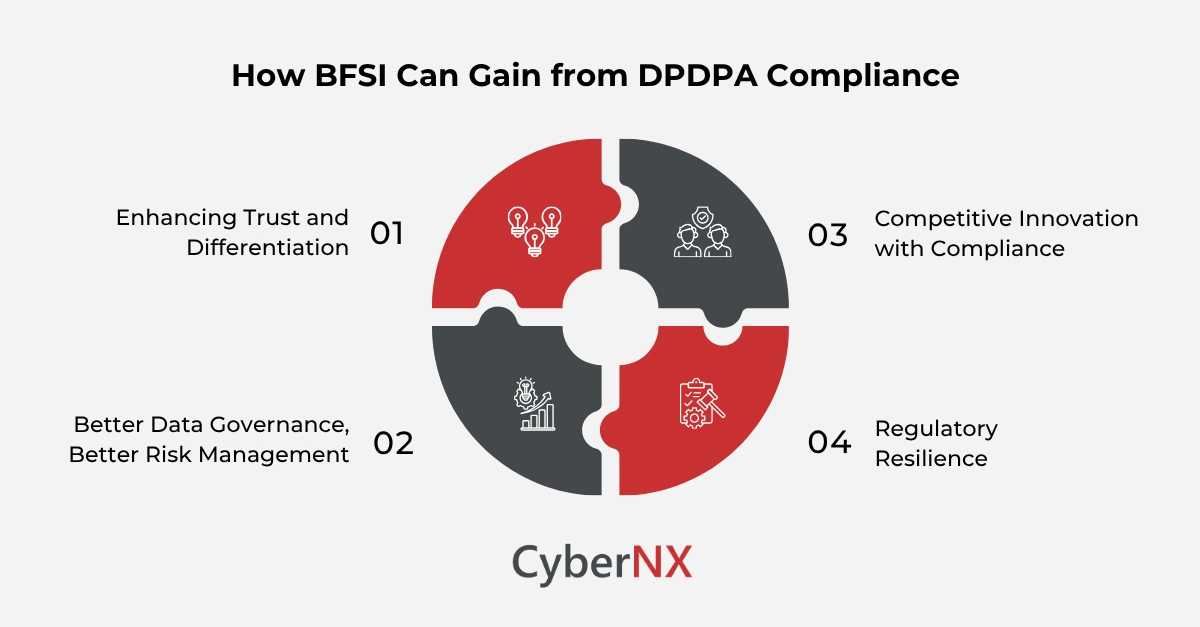

Why the importance of the DPDP Act for BFSI Sector is strategic

Let’s look at why this is not just another regulation – and how firms can turn compliance into a strategic advantage.

1. Enhancing trust and differentiation

When you treat data protection not just as a checkbox, but as a promise to your customer, you strengthen trust. The DPDP Act’s rights-based approach gives firms the chance to position themselves as privacy-first. For businesses, this is an opportunity. If you implement consent and data-governance well, you can turn it into a market differentiator.

2. Stronger data governance means stronger risk management

In BFSI, data is used for credit scoring, underwriting, fraud detection, customer segmentation etc. The DPDP Act forces clarity on how data is collected, processed and retained. This can reduce:

- misuse of data

- data-breach risk

- regulatory penalties

3. Competitive innovation with compliance

Many firms think compliance slows innovation. However, the DPDP Act can aid innovation by providing a clear framework for using anonymised/pseudonymised data, enabling safe analytics, partnerships, and fintech integrations. But this is only true provided data governance is strong.

In addition, BFSI firms need to keep in mind the guidelines and principles governing DPDPA to fully gain advantage from it. Those firms ready to embed privacy by design, this can accelerate trust-worthy product launches.

4. Regulatory resilience

Penalties under the DPDP Act are significant. For example, the Act provides for penalties up to ₹250 crore in certain cases. By proactively aligning governance now, BFSI organisations reduce the risk of enforcement, reputational damage and costly remediation.

What BFSI organisations should do to align

Having understood ‘why’, now let’s talk about the ‘how’. Below are key steps we recommend for BFSI entities.

Step 1: Conduct data mapping & inventory

You need to know what data you hold, where it is stored, how it flows, who processes it (internal & external). This gives the baseline needed to apply the provisions of the DPDP Act. Focus especially on high-sensitivity buckets: KYC, transactions, credit data, biometrics.

Step 2: Revisit consent and purpose architecture

Update your consent mechanics so that they are:

- clear and affirmative

- multilingual (as necessary)

- granular (purpose-specific)

- easily withdrawn

In the BFSI context, this means revisiting onboarding forms, digital wallet agreements, fintech-partner flows.

Step 3: Align retention, erasure and legacy systems

Decide on retention periods aligned to both regulatory mandates (e.g., RBI KYC retention) and DPDP-Act rules around deletion once purpose is complete. Where there are conflicts, document rationale and escalate. Legacy systems may not have built-in deletion workflows; invest accordingly.

Step 4: Vendor and third-party governance

Given the BFSI sector often outsources functions and partners with fintechs, you must ensure downstream parties comply. Contracts must have DPDP-Act-aligned clauses: vendor obligations, audits, breach responsibilities.

Step 5: Build monitoring-, audit- and incident-response frameworks

Ensure you can detect, report and remediate data breaches. Define roles such as a Data Protection Officer (DPO) (especially if you are an SDF). Conduct Data Protection Impact Assessments (DPIAs) for high-risk processing. Also embed KPIs and dashboards that track data risks, consent withdrawal rates, vendor compliance metrics.

Step 6: Communicate and train

Train teams across business units (IT, marketing, compliance, partnerships) on what the DPDP Act means for them. Communicate to customers your data-protection posture and data-use transparency. These builds trust and positions you ahead of peers.

Conclusion

The importance of the DPDP Act for the BFSI sector is not just about meeting another regulatory requirement. It represents a strategic inflection point: data governance, customer trust and operational resilience. Therefore, you need to begin by breaking down complex requirements and build simple, workable frameworks.

For many organisations, managing humongous amount of data can seem like a daunting task. You can always take help from experts who are well-versed in DPDP Act and compliance.

If you’d like to explore how we can help your organisation embed DPDP-compliant governance and turn it into competitive advantage, let’s talk. Our DPDP Act consultation services can help you build a robust data-governance framework, tailored as per the needs of for your BFSI operations.

Importance of DPDP Act for BFSI sector FAQs

Does the DPDP Act replace existing data-protection regulations for banks and financial institutions?

No. The DPDP Act adds a new layer of regulation. BFSI players still need to comply with sectoral regulators (RBI, IRDAI, SEBI) as well as the DPDP obligations.

Will every bank or insurer be classified as a Significant Data Fiduciary (SDF)?

Not automatically. The SDF designation is based on volume and sensitivity of data processed. But many large BFSI entities are likely to meet those thresholds.

How should organisations treat data they must retain for regulatory reasons, but which individuals request to erase under the DPDP Act?

They must balance the obligations: retain data as per the sectoral regulation (e.g., KYC) and document the retention basis. Where erasure is requested but cannot happen due to legal mandate, explain and record the exception.

Does the DPDP Act hinder innovation in fintech and BFSI platforms?

Not necessarily. When implemented well, the Act enables responsible innovation by using anonymised or pseudonymised data, clear consenting, and strong governance frameworks. It’s about doing it right.