There is an intense scrutiny on businesses today about cybersecurity compliance from Indian as well as world governments. This is because protecting personal information, sensitive company data and financial transactions are non-negotiable.

If your business is in a regulated sector, timely compliance is both a security as well as legal requirement. But compliance often feels like a moving target. One day you’ve ticked all the boxes and the next day, a regulator or auditor asks for more. More proof and more reports.

If you’re in a leadership role in security, you probably know this experience. You’re juggling business growth and customer trust. And somewhere in the middle of all this, compliance sneaks in. But it is important to protect data, win customer trust and avoid fines. That is why penetration testing compliance is one of the most effective shields your business can have.

What is Penetration Testing?

Let’s first understand what penetration testing is. Once you get a good grasp of this practice, you realize how it simplifies compliance. At its core, penetration testing involves simulating real-world cyberattacks on your IT system to expose and fix security vulnerabilities. You can test your web & mobile apps, cloud systems, APIs, network which are integral to any business function today.

For a deeper analysis, head to our blog Penetration Testing Guide.

What is Penetration Testing Compliance?

Now, let’s get to business. Penetration testing compliance is about two things: security and proof.

First, security – because a pen test shows you exactly how vulnerable (or resilient) your systems really are. Second, proof – because regulators, industry bodies and sometimes even customers want documented evidence that you’re not just talking about security but actively testing it.

In simple words, penetration testing compliance is showing regulatory bodies that you do comply with their standards. Once you achieve compliance, it is easy to show the same to business stakeholders.

Who Needs Penetration Testing Compliance?

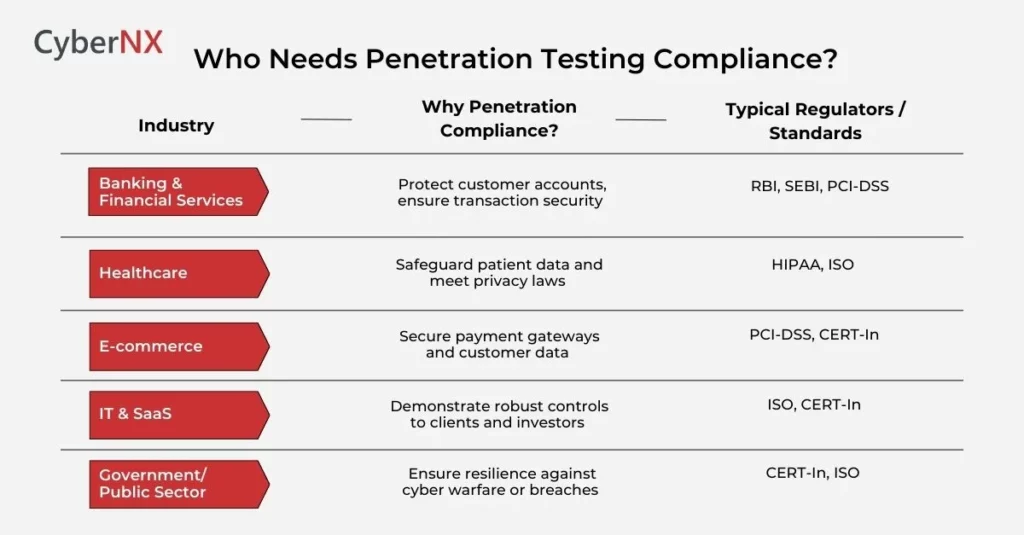

Pretty much any business handling sensitive data. If your business touches payments, healthcare records or financial systems. Plus, if you’re simply part of a regulated industry, you need compliance.

Here’s a quick chart to make it easier:

If you recognize your business in this table, know that compliance is essential. Also, make sure that the contract with the vendor clearly states the requirements.

Explore what, how and why with our blog Penetration Testing Contract. It will give you a better understanding about the topic.

Top Cybersecurity Regulations You Should Know

This is where things usually get messy for most organizations. Each acronym feels like a new language. Let’s simplify it.

1. PCI-DSS (Payment Card Industry Data Security Standard)

If you accept, process, or store credit card data, PCI-DSS is your bible. It requires regular penetration testing to ensure no weak points exist in payment systems. A pen test checks for flaws like insecure APIs, weak authentication and exposed customer data. Without it? You become non-compliant and you’re putting every card transaction at risk.

2. RBI (Reserve Bank of India) Guidelines

Banks and financial institutions in India follow RBI’s strict cybersecurity framework. Penetration testing compliance here isn’t optional; it’s integral to how you prove systems are secure against fraud, breaches and operational risks. Regular red-team style assessments make sure hackers don’t get the first shot.

3. SEBI CSCRF (Securities and Exchange Board of India – Cyber Security and Cyber Resilience Framework)

If you’re a stockbroker, mutual fund or any entity under SEBI, this one’s for you. Pen tests validate your trading systems and customer-facing platforms aren’t open doors for cybercriminals. Compliance here translates into trust, both with regulators and with investors.

4. CERT-In (Indian Computer Emergency Response Team)

CERT-In empanelled audits are mandatory for many organizations. Pentesting compliance here means not just doing the test but getting it done by CERT-In–approved vendors. It’s about ensuring that assessments meet national-level standards and can withstand scrutiny in case of incidents.

5. ISO (International Organization for Standardization)

ISO 27001 is the global gold standard for information security. While it doesn’t explicitly demand penetration testing, auditors often expect it as proof of your controls’ effectiveness. A regular pen test makes your ISO compliance smoother, faster and far less painful.

6. HIPAA (Health Insurance Portability and Accountability Act)

If you’re in healthcare, HIPAA rules your world. Penetration testing compliance ensures patient data, everything from prescriptions to lab results, isn’t left unprotected. It shows regulators you’ve taken real steps to secure electronic health records.

In short, each standard might phrase it differently. But the message is the same: prove your security through regular, professional penetration testing.

Benefits of Penetration Testing Compliance

Compliance may seem like a burden. But here’s where the silver lining shows up. There are benefits way beyond just ticking regulatory boxes.

1. Stronger Defences, Real-World Tested

You’re not relying on theory or hope. Pen testing compliance gives you battlefield-tested insights into where attackers would strike and how to fix it.

2. Fewer Sleepless Nights Before Audits

Instead of scrambling last minute, penetration testing compliance ensures you have audit-ready reports at hand. When auditors ask, you can easily and simply hand over testing and compliance proof.

3. Customer and Investor Confidence

Compliance reports are more than paperwork. Think of it as trust signals for existing as well as potential customers. They reassure customers and investors that their money, data and health records are safe in your hands.

4. Reduced Breach Costs

Let’s face it: a single breach can wipe out years of brand equity. Compliance-driven pen testing drastically lowers the chance of such disasters, saving you millions in cleanup costs, fines and reputational damage.

5. Competitive Advantage

This might be a little-known benefit: many organizations use penetration testing compliance as a sales differentiator. When a client compares vendors, the one with bulletproof compliance almost always wins.

Conclusion

At the end of the day, penetration testing compliance is about more than satisfying auditors. It’s about protecting what matters most – your business, customers and reputation.

Yes, it takes time and costs money. But the cost of non-compliance, from financial penalties, lawsuits to reputational harm, makes the investment look small in comparison.

If you’re a CTO, CISO or IT security leader reading this, here’s the bottom line: don’t wait until a regulator, client or cybercriminal forces your hand. Make penetration testing compliance a proactive strategy.

CyberNX is a CERT-In empanelled cybersecurity firm offering penetration testing services. With 100+ certified professionals, automation capabilities and advanced technology, we expose hidden vulnerabilities and protect your business 24/7. Contact us today.

Penetration Testing Compliance FAQs

How often should penetration testing compliance be performed?

Most standards recommend at least once a year or after major changes in your infrastructure. High-risk industries like banking or healthcare may need more frequent assessments.

Can internal teams handle penetration testing for compliance?

While internal teams can do basic assessments, compliance usually requires third-party, independent pen tests for credibility and regulatory acceptance.

Does penetration testing compliance differ across countries?

Yes. While the core idea is the same, regional regulators (like RBI in India or HIPAA in the U.S.) define their own requirements. Global organizations often need a blended compliance strategy.

What happens if my business fails a penetration testing compliance audit?

Failing doesn’t mean the end – it’s a signal to fix gaps quickly. Regulators typically allow remediation periods, but repeated non-compliance can lead to penalties, fines, or even business restrictions.