Financial institutions are experiencing a period of heightened scrutiny. Supervisory teams expect stronger accountability, clearer structures and deeper visibility across technology and cyber operations. This has made the gap assessment for RBI IT governance compliance a critical exercise for NBFCs and other regulated entities.

A well-designed assessment helps leadership understand how governance, security and continuity align with the expectations laid out in the RBI’s IT governance and cyber resilience directions. It also reveals the deeper issues that influence audits, inspections and long-term readiness.

Many institutions that have policies and committees in place still struggle with governance gaps that surface only during regulatory reviews. This guide highlights the areas that matter most.

Why gap assessment plays a central role in RBI IT governance alignment

The RBI Directions push organisations to adopt a more structured model for technology oversight. A gap assessment acts as the foundation for this journey. It provides clarity across several areas that influence compliance, including governance maturity, reporting structures, control effectiveness and operational readiness.

Regulated entities often work across diverse environments. Some systems run on legacy platforms, while others rely on cloud-native services. Several business functions interact with third parties. These layers make consistency difficult. A detailed assessment brings visibility to these complexities and helps institutions build resilience with intention.

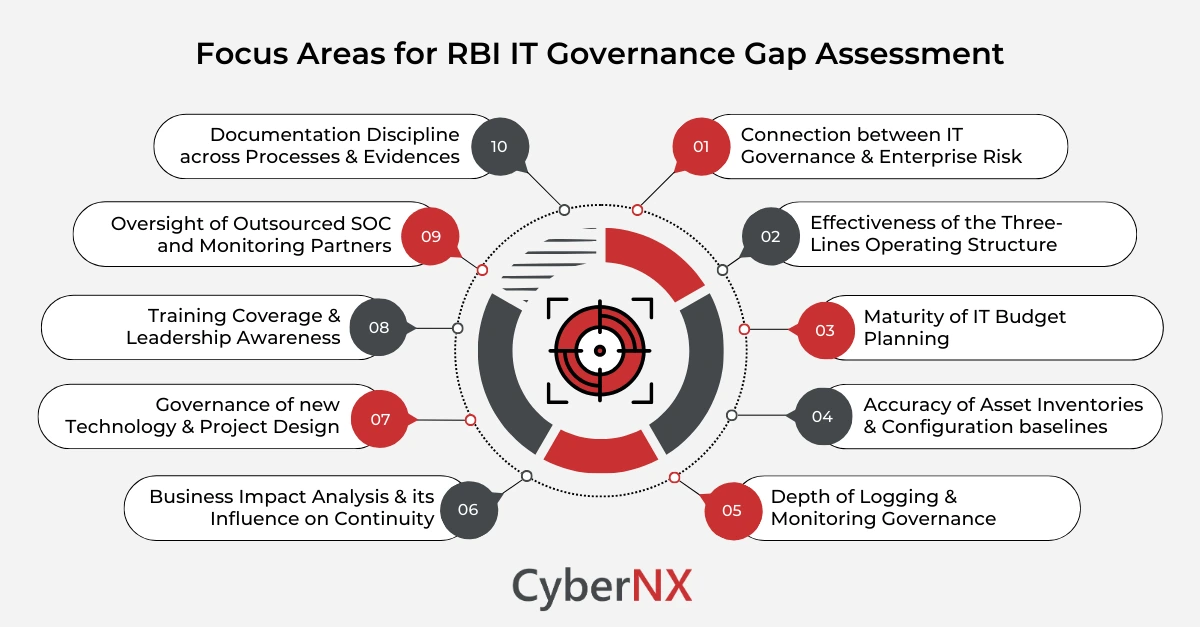

Key areas to examine during a gap assessment for RBI IT governance compliance

The sections below reflect what supervisors typically expect. They move beyond checklists and look at deeper governance mechanisms that influence resilience.

1. Connection between IT governance and enterprise risk

RBI directions encourage a governance model where technology risk sits within the broader risk framework. A gap assessment reviews how well the organisation integrates IT risk, cyber risks and operational risks into enterprise dashboards and leadership conversations.

Institutions benefit when risk appetite, metrics and reporting structures align. This creates consistency and allows leadership to understand exposure with greater clarity.

2. Effectiveness of the three-lines operating structure

A strong governance model depends on clear responsibilities across the first line, second line and internal audit. During a gap assessment, the organisation’s ability to maintain independence and avoid role overlap becomes a major point of focus.

Teams that understand their responsibilities operate more confidently. This model also helps institutions demonstrate objectivity during supervisory reviews.

3. Maturity of IT budget planning

The RBI places emphasis on technology budgets that reflect digital depth and threat conditions. A detailed assessment reviews how budgets evolve, how they support resilience and whether resource allocation reflects actual risk.

We often see institutions that maintain strong governance structures but still struggle with budget alignment. Addressing this improves long term stability.

4. Accuracy of asset inventories and configuration baselines

Inventories must remain complete and synchronised across tools, CMDB and procurement lists. During a gap assessment for RBI IT governance compliance, discrepancies become a clear indicator of operational weakness.

Accurate inventories act as a foundation for patching, monitoring, access control and recovery planning. Weakness in this area can create multiple control failures.

5. Depth of logging and monitoring governance

The directions expect complete logs for critical systems and clear retention policies. A gap assessment reviews log coverage, event correlation and escalation quality. Institutions with strong monitoring practices detect issues earlier. They also respond more effectively during incidents.

6. Business impact analysis and its influence on continuity

A well-structured impact analysis remains essential. It helps define system criticality and shapes RTO and RPO targets. During a gap assessment, the organisation’s ability to maintain alignment between business priorities and technology capabilities becomes a key focus.

When business teams and technology teams share a consistent understanding, continuity planning becomes more reliable.

7. Governance of new technology and project design

RBI directions emphasise structured decision making. A compliance assessment reviews how new projects move through governance pathways, design reviews, risk assessments and pre-deployment validation.

This area often reveals gaps that arise from rapid digital expansion. Improving it helps institutions strengthen long term resilience.

8. Training coverage and leadership awareness

Cyber awareness plays a central role in governance maturity. A gap assessment examines how well employees understand their responsibilities and whether training extends to privileged users and leadership. Institutions that invest in awareness gain better response capability during incidents.

9. Oversight of outsourced SOC and monitoring partners

Many NBFCs rely on external monitoring partners. The RBI expects strong governance of these services. A detailed assessment reviews clarity of responsibilities, escalation paths, performance metrics and incident handling quality.

This strengthens detection and maintains confidence in outsourced operations.

10. Documentation discipline across processes and evidences

Policies may exist on paper, but procedures, approvals and evidences must remain consistent. A gap assessment evaluates whether teams follow defined processes and maintain records that demonstrate adherence.

Strong documentation reduces supervisory risk and makes regulatory interactions smoother.

How CyberNX supports organisations during gap assessments

At CyberNX we work closely with NBFCs and other regulated entities to understand the maturity of their governance structures and technology controls. Our assessments reveal where responsibilities overlap, where reporting needs clarity and where stronger processes can improve resilience.

We help leadership recognise trends that influence future decisions. The aim is to build confidence, reduce uncertainty and enable teams to operate with purpose.

Conclusion

A well-executed gap assessment for RBI IT governance compliance offers far more than a readiness snapshot. It reveals how strongly governance aligns with risk, how resilient operations remain under pressure and how well teams understand their responsibilities. It brings clarity to leadership. It highlights areas that shape long term resilience. It also supports smoother regulatory interactions.

Institutions that invest early create a stable foundation for the future. They understand their environment with greater depth and make decisions with confidence. Plus, they strengthen their ability to operate securely in an evolving landscape.

Connect with us for a detailed review aligned to the RBI Master Directions. Our experts help you evaluate governance maturity and identify opportunities to strengthen resilience across your technology environment.

Gap assessment for RBI IT governance compliance FAQs

What makes a gap assessment for RBI IT governance compliance different from a standard IT audit?

A standard audit examines control effectiveness. A governance compliance assessment examines maturity, independence, risk alignment and strategic oversight. It focuses on structure as well as control design.

Does the RBI specify a formal format for IT governance gap assessments?

No. Institutions have the flexibility to design their approach. However, supervisors expect clarity across governance roles, reporting pathways and evidence of structured oversight.

Which areas usually show early gaps during an RBI governance assessment?

Common gaps include asset inventory mismatches, weak linkage between IT risk and enterprise risk, inconsistent monitoring coverage and incomplete documentation.

How often should institutions review their governance maturity?

Annual reviews are preferred. Many organisations conduct interim assessments when digital expansion, vendor changes or major system updates occur.