Banking today doesn’t look anything like it did a decade ago. Customers do not step into a brick-and-mortar branch as frequently as earlier. Payments are made instantly online. Credit approvals happen in seconds.

Everything feels seamless until it doesn’t. Because behind that convenience, there’s a reality most leaders in banking do recognize: the expanding attack surface, and cybercriminals waiting to target loopholes.

That’s where banking cybersecurity protocols and initiatives matter more than ever.

Assuring security is the very foundation of customer trust and business survival. If you’re leading a bank and adopting digital transformation, you probably already know the myriad challenges. New fraud techniques popping up every month. Regulators breathing down your neck. And of course, customers who expect safety.

So, while you modernize your banking infrastructure, how can you fit cybersecurity in the picture? This blog will help you understand how to future-proof your institution from modern threats and offer other valuable insights for security in banks.

What is Cybersecurity in Banking

Banking cybersecurity refers to the set of policies, controls, technologies, and practices deployed by financial institutions to protect their systems, data, and customers from malicious actors. In banks, it spans:

- Network security (firewalls, intrusion detection, segmentation)

- Application security (secure coding, penetration testing, input validation)

- Identity & access management (strong authentication, role-based access, least privilege)

- Data protection/encryption (in transit, at rest, tokenization, key management)

- Monitoring & threat detection (SIEM, anomaly detection, threat intelligence)

- Incident response & resilience (playbooks, backup, forensic readiness)

- Third-party and supply chain control (vendor risk assessments, continuous auditing)

- Governance, compliance & audit oversight

In banking, security must be embedded into digital transformation, cloud migration, API exposure and fintech integration. Plus, it should be woven into the evolving technologies like AI or quantum encryption.

Banks can’t treat cybersecurity as an afterthought or add-on; it must be designed in from day one.

Impact of Cybersecurity on Customers’ Trust in Banks

Trust is foundational in banking, and cybersecurity plays a central role in shaping it. Below are key data points from the recent Accenture “Guardians of Trust: Navigating Cybersecurity in Banking” report:

- 58% of banking customers across 39 countries say they are worried about the security of their personal/financial data and the risk of hacking when banks provide tailored products and services.

- Even though 81% of customers rate their own bank as doing well or excellent in data security, privacy and fraud protection, that trust does not extend to third-party service providers or the broader banking ecosystem (trust drops sharply for external vendors).

- Only 28% of customers believe their bank effectively communicates its cybersecurity practices. Lack of transparency erodes confidence.

- After a breach, 62% of customers lose confidence in their bank, and 43% disengage with the bank entirely.

- Banks that actively act as “guardians of trust” see 58% fewer data breaches over a three-year span and enjoy 1.5x higher customer retention rates.

As you can see, banking cybersecurity measures are at the core of customer relationship management, brand integrity and competitive differentiation.

Why Cybersecurity in Banking is a Different Ballgame?

Every industry is concerned about cyber threats. But banks, especially are. Why? Because money is the prize. And not just money, there’s data, trust and access. A single breach cost millions and it can impact an entire country’s financial stability.

Unlike a retail company that can patch a system quietly, banks are deeply interwoven into people’s daily lives. Missed payroll transfers, frozen ATMs or compromised mobile banking apps – all of these could cause huge problems for the entire society.

That’s why banking cybersecurity isn’t and shouldn’t be just about firewalls and encryption. The main goal should be preserving confidence in the entire financial system. The stakes are higher here than almost anywhere else.

The Shifting Threat Landscape in the Banking Sector

Remember when phishing emails used to be full of spelling mistakes and suspicious links? Those days are gone. Cybercriminals are now organized, well-funded and use tools to be creative. These are alarming signs for banks as the risks keep mutating.

Some of the latest threats include:

| THREAT | BANKING CONTEXT | WHY IT MATTERS |

| Ransomware | Locks core systems and customer data | Halts operations, high cost of downtime and recovery |

| Insider Threats | Employees or privileged users cause breaches (accidental/malicious) | Hard to detect, can bypass controls |

| Third-Party Risks | Fintech partners, cloud vendors, or API providers introduce weaknesses | Banks inherit vendors’ vulnerabilities |

| AI-Driven Fraud / Deepfakes | Attackers impersonate customers or executives | Rising fast (+243% YoY), undermines authentication |

| Phishing & Social Engineering | Tricking staff/customers to give up credentials | Still the #1 attack vector in banking |

| API / Open Banking Flaws | Poorly secured APIs leak data or allow fraud | Expands attack surface as digital services grow |

| Quantum Threat (Future) | Quantum computing could break today’s encryption | Banks must prepare with post-quantum cryptography |

No matter how well-defended you think you are, adversaries are often around or one step ahead. This is why banking cybersecurity demands constant evolution, not one-off fixes.

Bank-Specific Compliance Landscape

Banks face stricter scrutiny than most industries. Mapping compliance to cybersecurity controls can reduce overlap and cost:

- RBI Guidelines (India): Mandate risk assessments, incident reporting and cyber resilience frameworks.

- FFIEC Standards (US): Define best practices for authentication, data protection and response planning.

- GDPR (EU): Impacts data privacy, breach notifications and fines up to 4% of annual turnover.

- PCI DSS (Global): Governs cardholder data security, requiring strict encryption, monitoring and segmentation.

An IT Head’s challenge is to consolidate these frameworks into a single control set, ensuring compliance without duplicating effort. Aligning banking cybersecurity with compliance is also a way to secure board-level attention.

Why are Banks under more pressure now than previously?

This is because of hackers of course. But beyond that it’s the environment banks operate in:

- Digital-first customers: People expect 24/7 access across apps, devices, and geographies. That means more endpoints to protect.

- Regulatory demands: From GDPR to PCI DSS to RBI or FFIEC guidelines – compliance isn’t optional, and it isn’t cheap.

- Cloud adoption: Great for speed and innovation, but it complicates control and oversight.

- Complex IT landscapes: Many banks still juggle decades-old core systems while layering on modern APIs and fintech integrations.

Every one of these adds pressure to ensure bulletproof security in banks – even when budgets, time and people are stretched thin.

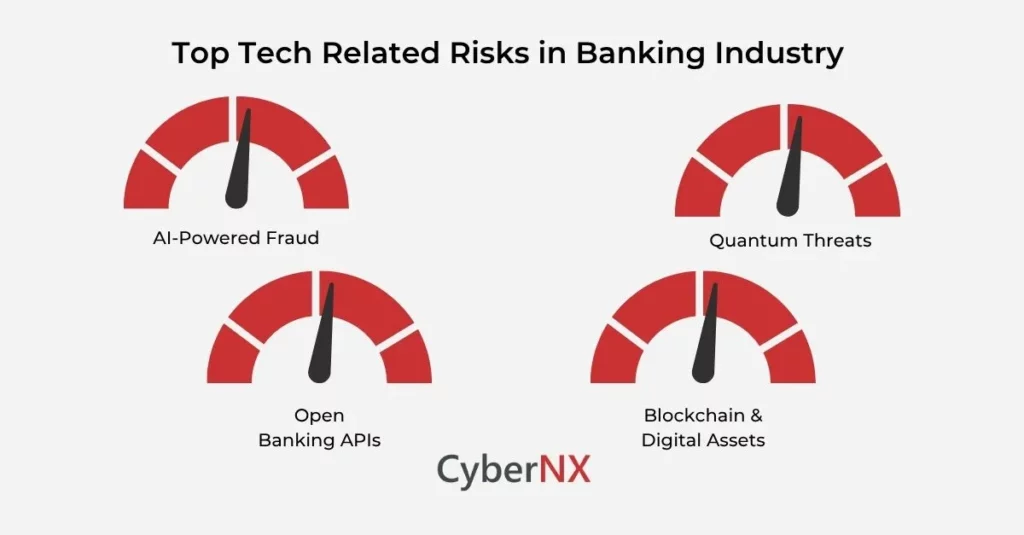

Emerging Technology Risks in Banking

Business remodelling via digital transformation accelerates risks that IT Heads must anticipate now:

- AI-Powered Fraud: Deepfakes and synthetic identities can trick customer support teams or authentication systems. AI-driven fraud detection must be implemented in response.

- Quantum Threats: Within a decade, quantum computing could break today’s encryption. Banks need to start adopting quantum-resistant cryptography strategies.

- Open Banking APIs: APIs enable innovation but can also leak sensitive data if not secured with proper authentication, encryption, and monitoring.

- Blockchain & Digital Assets: Smart contracts and crypto integrations can introduce vulnerabilities, from coding flaws to cross-chain risks.

These technologies promise efficiency but require security-first adoption to avoid long-term systemic risks.

The Cost of Getting it Wrong for Banks

Breaches are devastating. In banking, the stakes are even higher. Beyond fines and payouts, the deeper damage is reputational.

Smaller banks, especially, may not recover. One major ransomware attack or a data breach exposing customer accounts can lead to mass customer exits. And in today’s hyper-competitive financial market, loyalty is fragile.

So, when leaders talk about banking cybersecurity as “strategic,” they’re not exaggerating. It’s as core to survival as liquidity or capital reserves.

Case Studies of Banking Cyber Incidents

Real-world incidents provide the sharpest lessons for IT leaders.

- Capital One Breach (2019): Exploited a misconfigured firewall in AWS, exposing data of over 100 million customers. Lesson: Cloud misconfigurations can be just as dangerous as on-prem weaknesses; continuous configuration monitoring is non-negotiable.

- Bangladesh Bank Heist (2016): Attackers compromised SWIFT credentials, attempting to steal $951M (they got away with $81M). Lesson: Endpoint security and identity verification in payment systems must go beyond traditional controls.

- Cooperative Banks in India (2020–2022): Multiple ransomware and phishing attacks crippled operations. Lesson: Smaller banks are not immune; attackers often target them precisely because they lack the layered defences of larger institutions.

These cases highlight the need for tight identity controls, third-party oversight and constant monitoring, regardless of bank size.

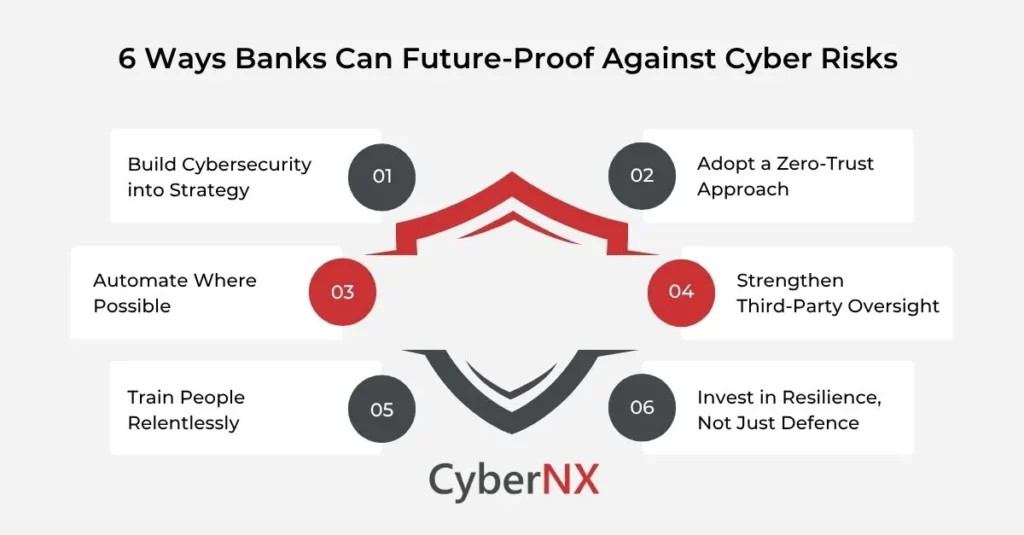

How Banks Can Future-Proof Against Cyber Risks

Here’s the part that matters most: what can you do about it? There’s no silver bullet. But there are proven ways banking cybersecurity can strengthen defences without grinding innovation to a halt.

1. Build Cybersecurity into Strategy

Too many banks still treat security as an IT problem. It’s not. It’s a business issue that needs boardroom visibility. Make sure executives understand that investing in cybersecurity isn’t just about avoiding fines – it’s about protecting the bank’s very license to operate.

2. Adopt a Zero-Trust Approach

It sounds like a buzzword, but it’s powerful. Trust nothing, verify everything. From internal employees to external vendors, every access request gets validated continuously. This reduces the risk of both insider threats and compromised accounts.

3. Automate Where Possible

Manual patching? Manual monitoring? Forget it. With thousands of alerts daily, humans alone can’t keep up. Banks need automated tools for vulnerability management, fraud detection, and threat intelligence. It frees up teams to focus on real risks instead of drowning in noise.

4. Strengthen Third-Party Oversight

Fintech partnerships are great for innovation, but they also open new doors for attackers. Make vendor assessments, audits, and continuous monitoring a standard practice. If they’re part of your ecosystem, their risks are your risks.

5. Train People Relentlessly

You can have the best tech stack in the world, and one careless click still brings you down. Regular phishing simulations, gamified training, and executive workshops go a long way.

6. Invest in Resilience, Not Just Defence

Attacks will happen. What matters is how quickly you detect, contain, and recover. Build strong incident response plans. Run crisis drills. Ensure business continuity so customers barely feel the impact when something does go wrong.

These steps might sound familiar, but in practice, many banks implement them half-heartedly. If you want to truly future proof, it’s about depth, not checklists.

Cybersecurity ROI for Banks

Convincing the board to fund banking cybersecurity initiatives requires quantifying benefits. Here’s how you can explain it:

- Fraud Loss Prevention: Every prevented breach or fraudulent transaction directly saves millions.

- Regulatory Compliance: Avoiding fines from non-compliance with RBI, FFIEC, or GDPR saves money and protects reputation.

- Operational Continuity: Investing in resilience avoids costly downtime of ATMs, payment systems, and apps.

- Customer Retention: Trust is fragile; a breach can trigger mass customer exits, costing far more than the security investment.

Showing clear ROI helps IT Heads gain executive support for larger budgets and advanced solutions.

The Human Side of Cybersecurity in Banking

Behind all these systems and policies, there are people. Customers who trust you with their life savings. Employees trying to do the right thing but sometimes slips, and leaders are under immense pressure to keep everything going.

That’s why banking cybersecurity is really about trust management. Customers don’t understand encryption protocols or compliance frameworks. What they understand is:

- Did my money move safely?

- Is my information private?

- Will you stand by me if something goes wrong?

Every decision you make in cybersecurity should loop back to those questions. If the answer isn’t clear, rethink it.

What the Future Demands from Banking Industry?

The next five years will test banks in ways we can barely predict. Quantum computing could break current encryption standards. State-sponsored attacks may grow more aggressive. Customers will demand seamless security that doesn’t slow them down.

To stay ahead, banks need more than reaction. They need anticipation, continuous monitoring, adaptive defences and cross-industry collaboration.

And yes, it’s exhausting to think about. But there’s also opportunity here. Those that master banking cybersecurity will stand apart, not just as safe institutions, but as digital innovators customers can truly rely on.

How CyberNX Can Help Banking Industry

At CyberNX, we understand that banking leaders face the dual challenge of driving digital innovation while keeping operations secure and compliant. Our suite of cybersecurity services safeguards every layer of your ecosystem.

From payment systems and core networks to cloud technologies and mobile banking apps, we provide complete banking cybersecurity services. We protect sensitive customer data against advanced cyber threats. Also, our team empower banks to meet regulatory expectations and confidently scale innovation without compromising trust.

Here are the major services provided by CyberNX that help banks build and strengthen their security posture:

1. Managed Detection & Response (MDR)

We provide 24/7 monitoring with banking-specific threat models, ensuring rapid detection and response to targeted attacks that traditional tools often miss. Our MDR services include seasoned professionals, AI powered technology and global threat intelligence.

2. RBI Master Direction Compliance

Our experts help implement and maintain RBI Master Directions on cybersecurity, streamlining compliance while minimizing both operational and reputational risks. Our RBI Master Direction Compliance Services will assist you in meeting regulatory requirements with ease.

3. Vulnerability Assessment & Penetration Testing

As a CERT-In empanelled provider, we deliver in-depth auditing, vulnerability assessment and penetration testing services to uncover weaknesses before attackers do.

4. SBOM (Software Bill of Materials)

We give banks full visibility into their software supply chain, mitigating risks from third-party code and hidden dependencies. We help you build SBOM with our in-house build SBOM management tool.

5. Red Teaming

Our red teaming specialists simulate real-world cyberattacks to stress-test your defences, helping banks close security gaps before adversaries exploit them.

Conclusion

If you’ve read this far, you probably feel the weight of it already. Cyber risks in banking aren’t hypothetical, they’re daily realities. But here’s the encouraging part: you don’t have to get it perfect to build resilience. You just have to take it seriously, invest consistently and embed it into the DNA of your bank.

Because banking cybersecurity is more than technology or compliance. It’s about future-proofing trust. It’s about ensuring that when your customers log in at midnight, transfer money abroad, or tap their phone at a café, they never once stop to wonder, “Is this safe?”

Are you looking for a partner who can help you with comprehensive cybersecurity services ensuring compliance with regulatory bodies? We are just a phone call away. Contact us today!

Banking Cybersecurity FAQs

How does mobile banking increase cyber risks?

Mobile apps are now the primary touchpoint for customers, which makes them prime targets. Attackers exploit weak authentication, malware-infected devices, or unpatched app vulnerabilities. Strong multi-factor authentication and app hardening are critical, as part of the banking cybersecurity protocols.

What’s the role of regulators in banking cybersecurity?

Regulators set the minimum bar for security in banks. Frameworks like RBI guidelines, FFIEC standards and GDPR require banks to adopt consistent practices in data protection, incident reporting and resilience planning.

Can smaller regional banks really compete with big banks in cybersecurity?

Yes, but they need to be smart about it. Instead of replicating the massive in-house setups of global players, regional banks can lean on managed security services, automation, and vendor partnerships to achieve strong defences without overspending.

How do customer expectations shape banking cybersecurity today?

Customers assume their money and personal data are always safe, but they rarely see the work happening behind the scenes. Any breach – no matter how small – can break trust instantly. This pressure pushes banks to go beyond compliance, making security seamless and invisible so that trust becomes part of the customer experience.