RBI Master Direction Compliance for IT: NBFC, HFC

Regulatory Compliance Consulting Services from CyberNX

Implement and maintain compliance with RBI’s Master Directions with CyberNX’s expert guidance.

Request a Free Consultation

INTRODUCTION

RBI Master Direction Compliance for NBFCs and HFCs

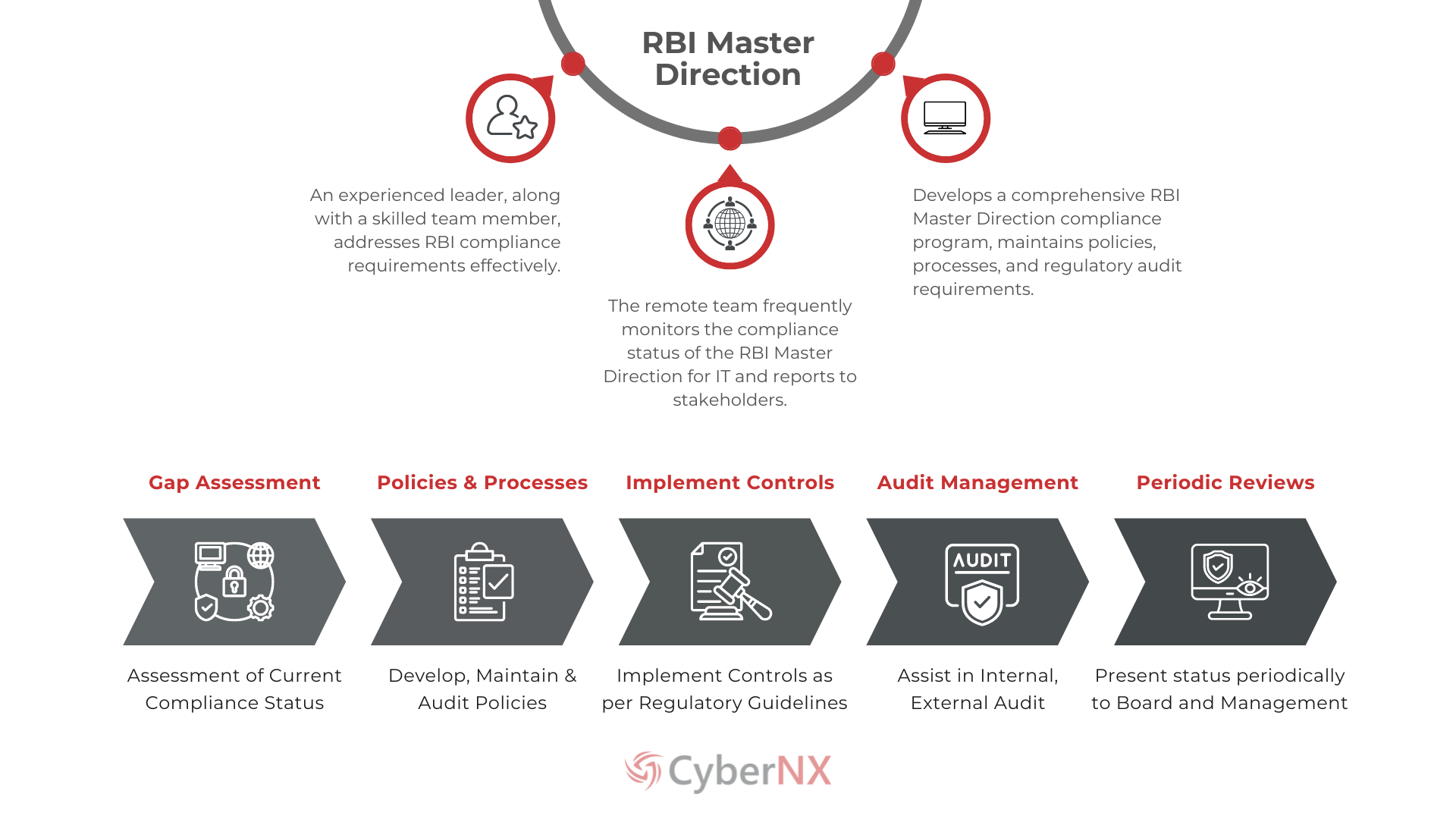

For RBI Master Direction Compliance for IT, requirements must be carefully outlined and mapped to an organization’s policies and procedures. It is also necessary to make sure that the board and top leadership are in line with these regulatory requirements. Our compliance services help you set up a plan for how to successfully implement and maintain these regulatory requirements.

We address your key challenges:

Understanding RBI Master Direction

Companies need to learn the RBI Master Direction in detail and connect it to their policies and procedures.

Developing a Compliance Roadmap

Organizations need to make a compliance roadmap and keep an eye on their progress on a regular basis.

Sustaining the Control Implementations

After a one-time implementation, the standards must be kept up to date every year to make sure they are always followed.

Periodic Assessments

Organizations must do regular checks of their compliance with the RBI Master Direction to see where they stand.

PROCESS

How It Works?

APPROACH

Why Choose us for Security Training?

CyberNX provides specialized services for following the RBI Master Direction to make sure that rules are followed. We make sure compliance is followed and keep it up to date by offering a structured and reliable framework that meets RBI’s regulatory requirements.

01

Experienced Professionals

Our expert team oversees making sure that the standards of the RBI Master Direction are met.

02

Trained Support Team

We deploy a skilled support team to assist with various cybersecurity activities for compliance.

03

Based on Standards

Our RBI Master Direction Compliance programs follow well-known safety rules for computers, like ISO 27001 and NIST.

04

Automation and Tools

We use advanced tools and automation systems for compliance so that it should be done quickly and efficiently.

05

Compliance Assessments

We do assessments for evaluation, such as regulatory compliance and partner security evaluations.

Looking for RBI Master Direction Compliance or Sustenance Services?

BENEFITS

Compliance with RBI Master Direction

Expert Leadership

Your RBI Master Direction compliance program will be led by experienced security leaders who will make sure it follows the right strategic path for your business.

Granular RBI Master Direction Compliance Tracking

Create and use a detailed RBI Master Direction Compliance Tracking system that fits with your company's goals.

Periodic Check for Compliance

To check compliance status on a regular basis, you should do assessments such as regulatory adherence and vendor security reviews.

Security Strategy

To improve your overall security, make sure that following RBI Master Directions is in line with your overall security plan. This includes keeping up with policies, suggesting security tools, and getting help with budgeting.

Testimonials

Customer first Approach is our guiding principle.

We listen, adapt, and deliver solutions that empower your success.

The leadership and team are committed to delivering exceptional quality and top-notch

customer service.

CIO of One of India’s Top Fund House

Top-notch MDR service with exceptional alert quality and brilliant response.

CISO, One of India’s biggest Law Firms

Peregrine MDR provides thorough, 24/7 monitoring of our environment, ensuring constant

vigilance and response.

CIO, Leading Fintech Company

We are highly impressed with CyberNX's PinPoint Red Teaming Services for their precision and

effectiveness in identifying security vulnerabilities.

CISO of a Leading Pharma

The MSP247 Team's commendable multi-cloud skills enable them to manage complex cloud

environments with expertise and efficiency.

Head Infrastructure of a Leading NBFC

CyberNX's nCompass GRC team stands out as one of the most experienced and skilled

teams I've had the opportunity to work with.

CISO, India’s Largest cash management company For Customized Plans tailored to Your Needs,

Get in Touch Today!

RESOURCES

Cyber Security Knowledge Hub

Explore our resources section for insightful blogs, articles, infographics and case studies, covering everything in Cyber Security.

FAQ

Frequently Asked Questions

01What is RBI Master Direction Compliance?

RBI Master Direction Compliance is a regulatory requirement for NBFCs, HFCs, Payment Banks, and Small Finance Banks. This framework outlines Technology Governance and Cyber Security requirements to ensure robust compliance and risk management.

02How is RBI Master Direction Compliance Service Helpful?

CyberNX’s RBI Master Direction Compliance Services help organizations implement compliance strategies tailored to their specific needs and regulatory profiles. Through thorough assessments, we identify compliance gaps and implement proactive measures to ensure adherence during regulatory audits.

03Do You Use Tools and Automation Frameworks in RBI Master Direction Compliance?

Yes, our Regulatory Compliance Services employ a range of tools and automation frameworks to enhance compliance governance implementation. These tools streamline processes, improve efficiency, and expedite the implementation and management of compliance frameworks.

04How Are CyberNX’s Regulatory Compliance Services Different?

CyberNX stands out in regulatory compliance services by leveraging experienced leadership, a trained team, a robust technology framework, and advanced automation tools. In addition to compliance specialists, CyberNX employs a dedicated team of professionals to execute various activities such as implementation and reviews, ensuring comprehensive and effective compliance management.